At the Annual Shareholders' Meeting in February 2017, Novozymes’ shareholders elected me as Chairman and Ms. Agnete Raaschou-Nielsen as Vice Chairman of the Board. We also welcomed new board members Ms. Kim Stratton and Mr. Kasim Kutay. Given these changes, 2017 was focused on consolidating the new Board and priming Novozymes for future growth.

Establishing a strong team

As the new chairman, I spoke with each individual member about how they could best contribute to Novozymes’ Board. The purpose was to ensure that not only do we have the right competencies on the Board but also that we utilize each member’s skills and experience. The combined strength of all its members is what makes Novozymes’ Board operate effectively. This strength also makes us the best sparring partner for the Executive Leadership Team.

During the year, the Board of Directors and board member Mr. Heinz-Jürgen Bertram made the joint decision to part ways in order to avoid any potential conflict of interest as the world of ingredients and industrial biotechnology develops. I would like to thank Mr. Bertram for his hard work and dedication to Novozymes.

Driving strategic direction

As in previous years, the Board conducted reviews of Novozymes’ business and of the mid- and long-term strategies for its main industries. We can see that we have good momentum for the strategic journey ahead. The divisions and functions have clear roadmaps and plans that are in progress. We can see that we benefit from our divisional setup, which has given us much closer links between divisions, application R&D and customers.

We also looked at Novozymes’ competitive advantages and how we can help take advantage of what sets the company apart from its competitors.

Here is an update on what we see as key priorities for the coming years:

We aim to accelerate growth in our core business through a dedicated emerging-market push, especially within Food & Beverages and Household Care. This involves tailoring our solutions to local market needs, developing stronger partnerships with regional customers, providing more affordable solutions and expanding our physical presence.

With a strong core in place, we can expand and diversify our business by building new growth areas. Animal health and water are two promising areas that we intend to pursue. We will also consider how to engage in human health. Agriculture is already considered part of our core business, which we will continue to grow and expand based on the potential.

New Nomination and Remuneration Committee

In 2017, the Board set up a new Nomination and Remuneration Committee consisting of three board members. The committee has taken a new approach to assessing the Board and its composition. It worked on proposing a new member of the Board and supported CEO Peder Holk Nielsen in the recruitment of Ms. Prisca Havranek-Kosicek as the new CFO of Novozymes.

In December 2017, the Board of Directors proposed that Ms. Patricia Malarkey be elected to the Board. Ms. Malarkey is an experienced R&D business leader from Scotland. She has more than 30 years’ experience in the global agrochemical industry. I am convinced that Ms. Malarkey’s strong research insight and

development experience, as well as her global perspective on a range of matters, will significantly contribute to the further development of Novozymes’ innovation processes and agenda.

Establishing a diverse and talented team is important to ensure future growth in a global company.

These were just a few of the activities and subjects we covered during this eventful year. I have enjoyed my first year as Chairman of the Board and look forward to 2018.

Jørgen Buhl Rasmussen

Chairman of the Board of Directors

Novozymes A/S

In accordance with Danish legislation, Novozymes has a two-tier management system comprising the Board of Directors and the Executive Leadership Team, with no individual being a member of both. The division of responsibilities between the Board of Directors and the Executive Leadership Team is clearly outlined and described in the Rules of Procedure for the Board of Directors and the Rules of Procedure for the Executive Leadership Team, available on Novozymes.com.

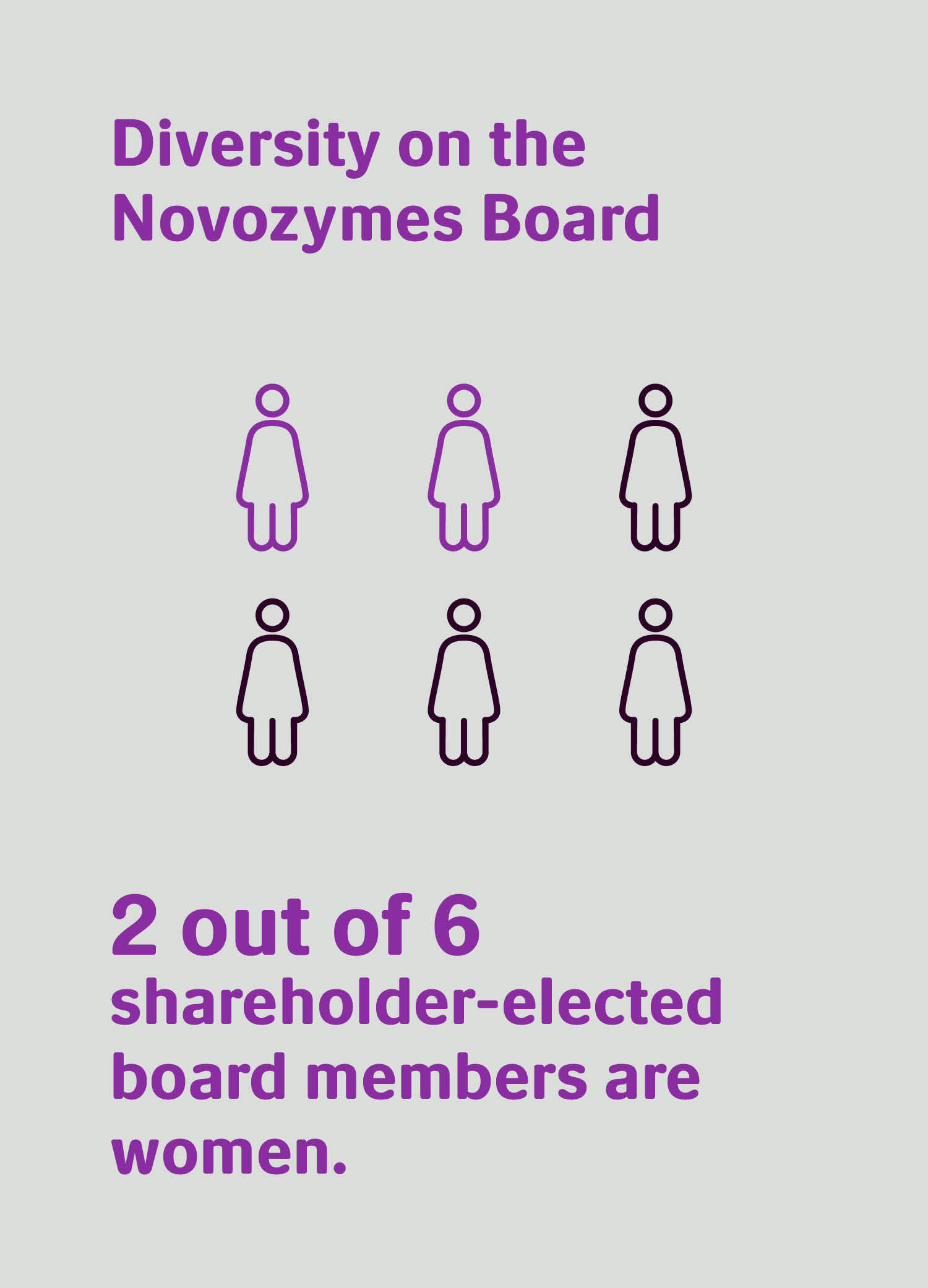

Novozymes’ Articles of Association require the Board of Directors to have four to eight members elected at the Annual Shareholders’ Meeting. Currently, the Board has six members. They are elected for one year at a time and

cannot be elected or re-elected after reaching the age of 70. Nominations are based on an evaluation of factors such as competencies, diversity, independence and prior performance.

The Board of Directors also includes three employee-elected members, who serve four-year terms. The Board of Directors is accountable to the company’s shareholders for the management of the company. The composition of the Board of Directors must therefore be such that the combined competencies of the Board enable it to inspire, guide and oversee the company’s development, and diligently address and resolve the issues and challenges faced by the company at any time.

To ensure the right competencies and promote diversity, the following targets have been set for the composition of the Board of Directors:

- At least half of the shareholder-elected board members shall be independent as defined in the Danish Recommendations on Corporate Governance.

- At least 40% of the shareholder-elected board members shall have substantial international experience from the management of large corporations or institutions headquartered outside of Denmark.

- One-third or more of the shareholder-elected board members shall be female, and one-third or more of the shareholder-elected board members shall be male.

All three targets were met in 2017. The required competencies are defined in a competency profile that specifies various personal characteristics, skills and experience. The individual competencies of the members of the Board of Directors are shown in the presentation of the Board of Directors and Executive Leadership Team.

The Board’s main responsibilities are to:

- Ensure the right management and organizational structure

- Supervise financial, social and environmental performance, and the Executive Leadership Team’s operational management of the company

- Decide the overall management and strategic development of the company

In accordance with the Articles of Association and the Rules of Procedure for the Board of Directors, the Board has a Chairmanship consisting of two members – the Chairman and the Vice Chairman – that is responsible for assisting the Board of Directors in matters concerning the Executive Leadership Team’s operational management of the company and reporting back to the Board of Directors. The Chairmanship is also responsible for planning and preparing meetings of the Board of Directors.

The Board of Directors established a Nomination and Remuneration Committee in 2017 to take over the matters relating to remuneration and nominations, which were previously carried out by the Chairmanship.

In addition, the Board of Directors has an Audit Committee that assists the Board of Directors in monitoring aspects relating to accounting, auditing, internal controls and financial, environmental and social reporting. Further information about the Audit Committee can be found on Novozymes.com.

As part of the internal control system, all cases of identified fraud and all concerns raised are investigated and reported to the Audit Committee and the Board of Directors. 49 investigation cases were reported in 2017. None of the investigated fraud cases had a material financial impact on Novozymes. Further information on fraud can be found in Note 8.3 to the Consolidated financial statements.

| Audit Committee meetings |

|

|

|

|

|

| Committee member |

Meetings attended |

| Lars Green |

|

|

|

|

|

| Agnete Raaschou-Nielsen |

|

|

|

|

|

| Jørgen Buhl Rasmussen |

|

|

|

|

|

|

|

|

|

|

|

| Nomination and Remuneration Committee meetings |

|

|

|

|

| Committee member |

Meetings attended |

| Jørgen Buhl Rasmussen |

|

|

|

|

| Agnete Raaschou-Nielsen |

|

|

|

|

| Kim Stratton |

|

|

|

|

|

|

|

|

|

Charters and recommendations

In laying down the management principles for Novozymes, the Board of Directors has followed the Recommendations on Corporate Governance that form part of the disclosure requirements applicable to companies listed on Nasdaq Copenhagen. These recommendations are available at Corporategovernance.dk. A detailed review of Novozymes’ position on all of the recommendations and a description of the internal control and risk management system relating to financial reporting can be found in the statutory report on corporate governance pursuant to section 107b of the Danish Financial Statements Act, at report2017.novozymes.com/governancereport2017.

The recommendations require companies to explain any noncompliance. Novozymes follows 45 of the 47 recommendations, the exceptions being:

The remuneration policy for the Executive Leadership Team contains no specific clause pertaining to the repayment of variable remuneration components paid on the basis of misstated information, as Novozymes considers the rules in Danish law to be sufficient in such cases (Recommendation 4.1.2).

Due to the limitations imposed by the Novo Nordisk Foundation’s Articles of Association and Novozymes’ ownership structure, the Board of Directors reserves the right in certain circumstances to reject takeover bids without consulting shareholders (Recommendation 1.3.1).

Furthermore, under the Danish Financial Statements Act (sections 99a and 99b) it is mandatory for large companies to report on corporate responsibility and equal opportunities. As a member of the UN Global Compact, Novozymes prepares a Communication on Progress, which is available under Sustainability indices & data at report2017.novozymes.com/sustainability/commitment. Together with the integrated financial, environmental and social reporting, the Communication on Progress meets both the requirements for reporting on corporate responsibility and equal opportunities, and the UN Global Compact’s advanced reporting criteria.

Novozymes also works within the parameters of Touch the World, the company’s values and commitments, and has committed to the principles of the UN Global CompactAn international UN initiative with the intention of bringing companies together with UN agencies, labor and civil society to support ten principles in the areas of human rights, labor standards, the environment and anticorruption. See www.unglobalcompact.org. and the UN Convention on Biological Diversity.

Other Board-related information

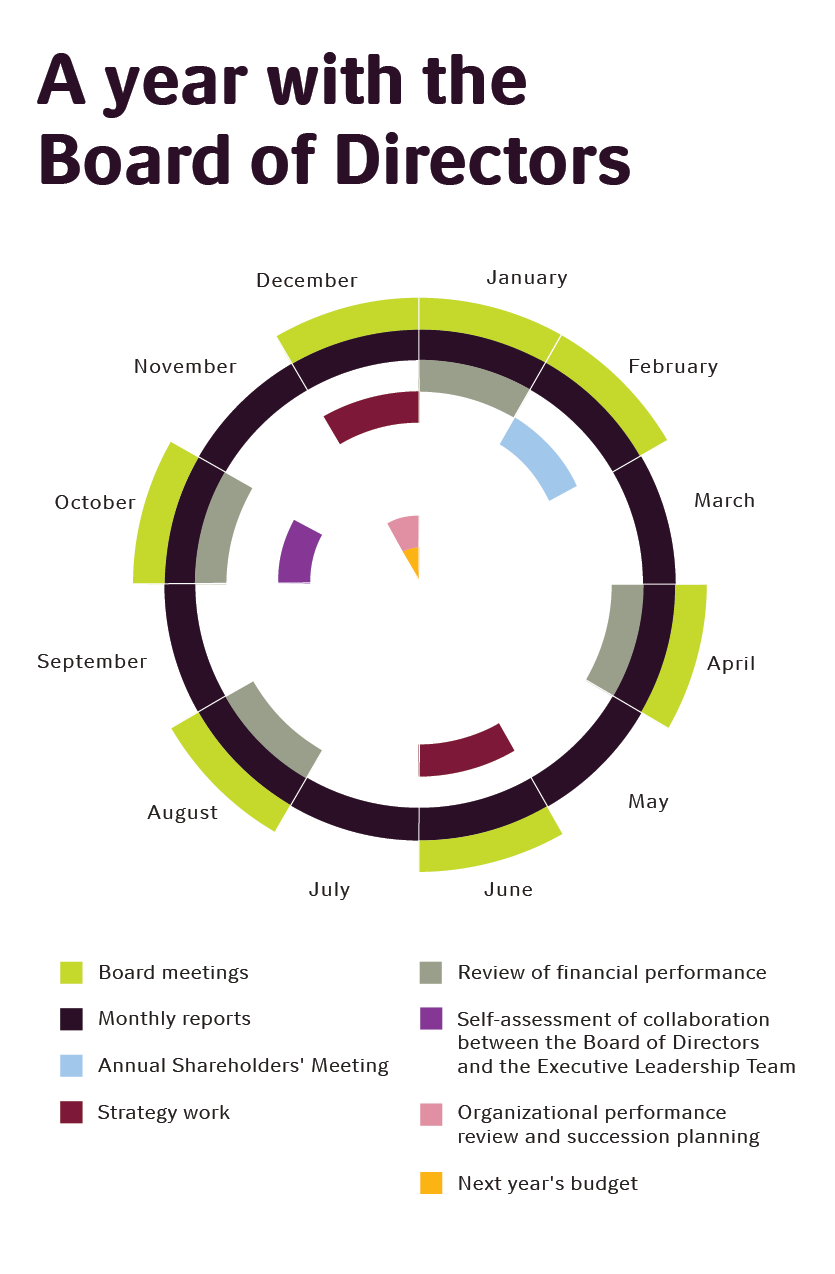

The Board of Directors held seven meetings in 2017, with an overall attendance rate of 98%.

Any changes to the Articles of Association require that shareholders representing at least two-thirds of the total number of votes in the company are represented at the Shareholders’ Meeting, and that at least two-thirds of the votes cast, as well as two-thirds of the voting capital represented at the meeting, are in favor of the proposal to change the Articles of Association.

The Annual Shareholders’ Meeting has authorized the Board of Directors to allow the company to acquire treasury stock on an ongoing basis, provided the nominal value of the company’s total holding of treasury stock does not exceed 10% of its share capital at any time, cf. section 198 of the Danish Companies Act.

The purchase price must not deviate by more than 10% from the price quoted on Nasdaq Copenhagen on the date of acquisition. This authorization applies until April 1, 2018. In addition, the Board of Directors has been authorized to reduce the share capital.

Each year, one of the responsibilities of the Board of Directors is to assess whether the capital and share structure of Novozymes is optimal. The Board of Directors remains of the opinion that the share structure with A and B common stock is the best way to safeguard Novozymes’ long-term strategy and development to the benefit of the company’s shareholders and other stakeholders.

Regarding capital structure, Novozymes will continue to favor a conservative balance sheet, reflected by a target for net interest-bearingThe market value of interest-bearing liabilities (financial liabilities) less the market value of cash at bank and in hand and other easily convertible interest-bearing current assets. debt of 0-1x EBITDA.Earnings before interest, tax, depreciation and amortization.This target was met in 2017.

Novozymes is party to a number of partnership contracts that can be terminated by the other party in the event of significant changes to the ownership or control of Novozymes. A few contracts contain provisions that restrict Novozymes' licenses to use specific forms of technology in such situations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Board member |

|

Nationality |

Board meetings attended |

Board tenure |

Election period |

|

| Jørgen Buhl Rasmussen1,2,4,5,7 |

|

Danish |

|

|

|

|

|

|

|

|

2011 |

1 year |

|

| Agnete Raaschou-Nielsen1,3,4,5,7 |

|

Danish |

|

|

|

|

|

|

|

|

2011 |

1 year |

|

| Heinz-Jürgen Bertram8 |

|

German |

|

|

|

|

|

|

|

|

2015 |

1 year |

|

| Lars Green1,4 |

|

Danish |

|

|

|

|

|

|

|

|

2014 |

1 year |

|

| Henrik Gürtler9 |

|

Danish |

|

|

|

|

|

|

|

|

2000 |

1 year |

|

| Kasim Kutay1 |

|

British |

|

|

|

|

|

|

|

|

2017 |

1 year |

|

| Kim Stratton1,5,7 |

|

Australian |

|

|

|

|

|

|

|

|

2017 |

1 year |

|

| Mathias Uhlén1,5 |

|

Swedish |

|

|

|

|

|

|

|

|

2007 |

1 year |

|

| Lena Bech Holskov6 |

|

Danish |

|

|

|

|

|

|

|

|

2013 |

4 years |

|

| Anders Hentze Knudsen6 |

|

Danish |

|

|

|

|

|

|

|

|

2013 |

4 years |

|

| Lars Bo Køppler6 |

|

Danish |

|

|

|

|

|

|

|

|

2010 |

4 years |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Elected at the Shareholders’ Meeting.

2. Chairman of the Board of Directors.

3. Vice Chairman. |

4. Member of the Audit Committee.

5. Independent.

6. Employee representative. |

|

7. Member of the Nomination and Remuneration Committee.

8. Resigned on June 8, 2017.

9. Resigned on February 22, 2017. |