Risk management framework

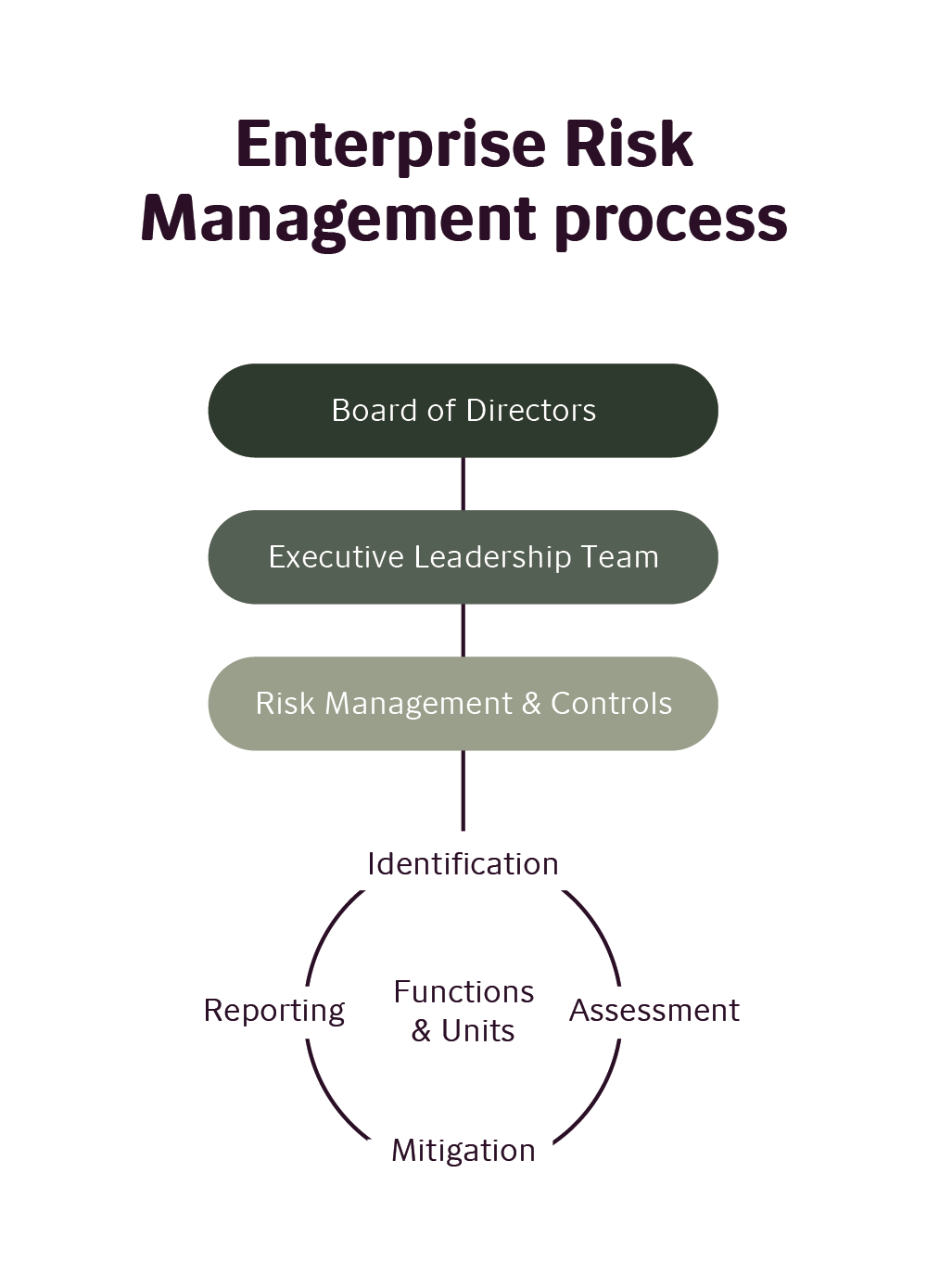

Novozymes operates an Enterprise Risk Management (ERM) process whereby the key risks facing the company are identified, assessed and mitigated at different levels of the organization. We monitor most risks through half-yearly reviews. However, some risks require more frequent updates.

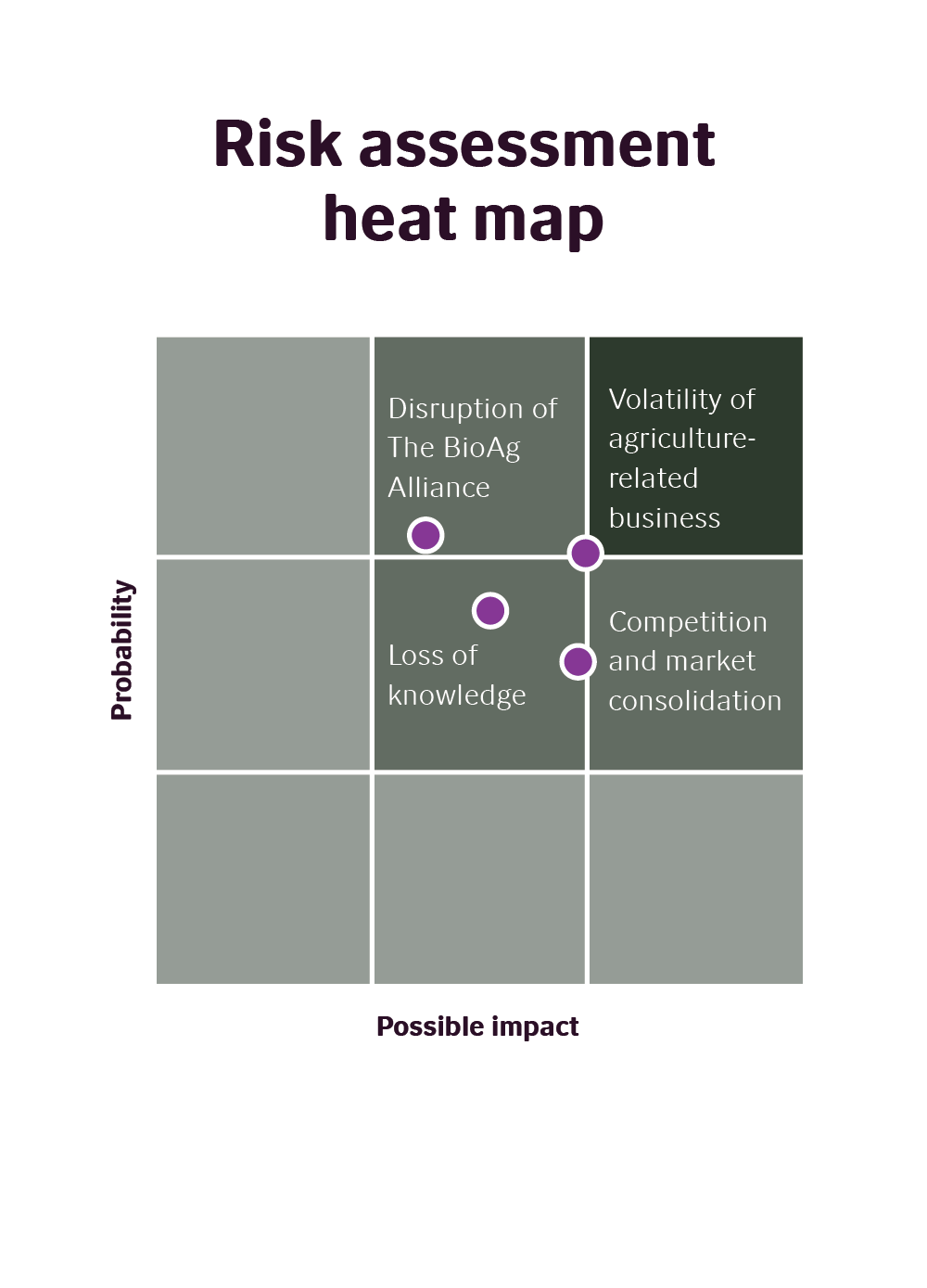

Risks are assessed based on a two-dimensional heat map rating system that estimates the impact of a risk on financials or reputation and the likelihood of that risk materializing.

The most significant risks are reviewed and assessed by the Executive Leadership Team and the Board of Directors. Novozymes’ Risk Management & Controls department is responsible for the process. The department also ensures that top management promotes risk awareness, involvement and ownership across the organization. Our vice presidents are responsible for all relevant risks and must work to mitigate them in their respective areas of responsibility.

Risk assessment

The key enterprise risks for 2018, situated in the upper-right corner of the risk heat map, are Competition and market consolidation, Volatility of agriculture-related business, Loss of knowledge, and Disruption of The BioAg Alliance. Three of the risks are similar to those identified for 2017, albeit with slight changes, while the risk related to Volatility of agriculture-related business is an extension of the previous risk related to Volatility of starch-based ethanol. These risks, their potential impacts and our mitigation efforts are described in this section.

Competition and market consolidation

Novozymes’ market-leading position could be challenged by competition from existing and potential new competitors. Consolidation among competitors and customers creates larger players with increased scale.

Potential impact

Increased competition could come from enzyme manufacturers offering new solutions or from new players with broader technology platforms. With increased digitalization, competition could also relate to how solutions are implemented in customer production and so on. Although consolidation has the potential to make the market more stable, it could increase our competitors’ and customers’ financial strength and bargaining power.

Mitigation

We are vigilant regarding competition and closely monitor the market to assess risks. We continuously innovate to ensure that our product portfolio contains the latest concepts and applications for a range of industries. This also enables us to open up brand new markets. In 2018, we will further prioritize and invest in digitalization. Among other things, we will use advanced analytics to extract business value faster and with greater impact. We will also build a Digital Solutions team tasked with spearheading commercial efforts in biofuels.

Volatility of agriculture-related business

In recent years, Novozymes has increasingly invested in the agricultural industry and related businesses, increasing our exposure. These markets are inherently volatile due to weather conditions, harvest quality, commodity prices, political mandates for ethanol blends, direct aid for farmers and so on.

Potential impact

Throughout 2017, agricultural markets remained somewhat depressed, putting a strain on farmers and ethanol producers. If this persists, it could challenge our value proposition, which, among other things, focuses on maximizing yield. Without political support for alternatives to fossil fuels, the ethanol industry could be further challenged, putting pressure on Novozymes’ profitability. In

bioenergy Comes in the form of liquid fuels, electricity, heat and steam, and is produced from primary crops or biomass such as sugarcane, grains, agricultural residues, algae and household waste. In liquid form, it is typically used to replace gasoline and diesel in transportation.

specifically, competing technologies such as enzyme-producing yeast and enzyme-expressing corn could threaten Novozymes’ market share.

Mitigation

Substantial R&D investments enable us to develop even better solutions for improving yield and profitability. In BioAg, the fruits of The Alliance with Monsanto are starting to enter our pipeline, with exciting launches due in the years ahead. In Feed, we are expanding our offerings within natural growth promotion, for example through our alliance with Boehringer Ingelheim. In Bioenergy, we continue to be the technology leader, introducing solutions that offer additional value beyond yield. We are also developing new solutions in yeast.

Loss of knowledge

It is extremely important to Novozymes to maintain a competitive edge in innovation. Hence safeguarding sensitive business information and critical assets against the global threat of theft is key. The Danish Ministry of Defence rates the overall risk of hacker attacks against Danish companies as “very high.”

Potential impact

Business opportunities with new or existing customers could suffer greatly if information about Novozymes' unique technologies or production strains is stolen. Cybercrime and hacker attacks are global issues that could also negatively impact Novozymes if systems are inaccessible for a long time.

Mitigation

Our more than 6,500 granted or pending patents act as our defense against infringement by competitors. We regularly evaluate how we can best safeguard our production strains and protect our new discoveries. In terms of cybercrime, we continue to optimize our efforts in cyber security and, in 2018, we will establish a Cyber Defense team that will monitor all our systems and respond promptly to adverse developments.

Disruption of The BioAg Alliance

Bayer’s pending acquisition of Monsanto entails uncertainty for The BioAg Alliance, in which Novozymes and Monsanto are partners. The uncertainty relates to the ability and willingness to continue The BioAg Alliance and the conditions for doing so.

Potential impact

Novozymes invests heavily in BioAg R&D and in our partnership with Monsanto. A merged Bayer–Monsanto could expand the reach of and opportunities for The BioAg Alliance. However, there are risks of delays related to the integration of The Alliance within a newly consolidated Bayer–Monsanto.

Mitigation

The acquisition is expected to be concluded in 2018. Novozymes’ short-term priority is to ensure the success of The BioAg Alliance and to derive full value from its product portfolio and especially its most recent additions to the portfolio: Acceleron® B-300 SAT and Acceleron® B-200 SAT. Novozymes is in a strong financial position and would be capable of continuing the BioAg activities in any eventuality.

Competition in industrial enzymes

Novozymes defends its market-leading position by focusing on strong innovation and novel solutions targeted at partners and customers.

In 2017, Novozymes’ innovation pipeline made significant progress. In particular, advancements in our freshness & hygiene platform are expected to mitigate threats from competitors in Household Care. Product launches aimed at emerging markets Markets that are progressing toward becoming more advanced, usually by means of rapid growth and industrialization.

and a multitiered pricing strategy also help give Novozymes a competitive edge. Our efforts to speed up our innovation pipeline and get closer to customers are also paying off, with the launch of new, tailored solutions.

In 2017, Novozymes continued to focus its innovation on key platforms to reshape the industry and challenge competition. Key focus areas included monitoring the competitive situation and concentrating on strengthening agility within the organization.

Volatility of starch-based ethanol business

Novozymes aims to ensure that biofuels are a viable and sustainable commercial alternative to traditional fossil fuels. That is why we continuously invest in R&D to develop even better enzyme solutions for improving biofuel Liquid fuels produced from primary crops or biomass such as sugarcane, grains, agricultural residues, algae and household waste. They are typically used to replace gasoline and diesel in transportation. One of the advantages of biofuels is that they are the only existing liquid alternative to fossil fuels.

yield and profitability. We also monitor competitor pricing in the industry to ensure that we deliver an optimal price/performance ratio with our products.

In 2017, Novozymes launched Spirizyme® T, an advanced suite of glucoamylases that free up residual sugar in corn so that it can be fermented into ethanol. The product was received well by customers.

To defend against competition from alternative technologies, Novozymes worked to develop yeast strains. We conducted commercial trials on these yeast solutions in 2017.

Our growth depends on innovations of this kind and on close relationships with the customers who use them.

Loss of knowledge

In 2017, Novozymes continued its active patent strategy by protecting discoveries, production strains, formulations and relevant know-how. Other actions were also taken to secure Novozymes’ assets through a continuously updated global information security strategy, IT governance, perimeter protection and access control.

A risk assessment carried out for Novozymes in 2017 showed that the threat from external intruders had been reduced. This reflects an improvement in information security, faster incident response and improved security awareness among Management and employees.

In 2017, Novozymes decided to establish a Cyber Defense team, tasked with continuously monitoring and reporting on any activities that could impair our systems.

Delay of BioAg commercialization

The BioAg Alliance continued to progress in 2017. The Alliance’s first codeveloped product, Acceleron® B-300 SAT for corn, was launched at the end of 2016 and was received well by the market. Its second launch was Acceleron® B-200 SAT, which enhances nutritional uptake in soy plants.

In 2017, Novozymes’ priority was to ensure the continued success of The Alliance with Monsanto. While Bayer’s acquisition of Monsanto is expected to take place, the anticipated conclusion of the deal has been delayed to 2018. Due to this postponement, the risk of short-term delays to BioAg commercialization continues into 2018.

Novozymes will monitor the situation and believes that there is a positive outlook for value creation with Bayer–Monsanto in The BioAg Alliance.

At Novozymes, we do not just look at risks affecting our business in the next 12 months; we also look at emerging risks capable of affecting our business, partners and customers in the longer term (i.e. in the next three years or more).

We monitor these macro trends through an Enterprise Risk Management process and other cross-functional trendspotting activities.

Novozymes currently tracks three specific emerging risks. To prepare for this evolving risk landscape, we engage with key stakeholders to foster a constructive dialogue and prioritize innovation in this area. Some of these emerging risks also pose opportunities for a business such as Novozymes with our strong focus on sustainability and innovative solutions.

Resistance to new technology

There is growing consumer demand for health, wellness and natural products and, conversely, tighter regulatory control on the biotechnology and chemical sectors. We expect an acceleration of technology and new significant innovation for these areas, and consequently potential resistance.

Consumers are more health conscious and express growing concerns about the intended and unintended consequences of biotechnology and genetic engineering on society. Governments are increasingly scrutinizing issues related to environmental and human health risks, bioethics, gene technology and intellectual property rights.

Global political and economic instability

Growing volatility in the global economy could impair business growth. This is driven by a mounting public backlash against globalization and the rise of anti-establishment sentiment and trade protectionism.

In many countries, polarization relating to vital social issues is making it more difficult for leaders to agree and work to strengthen global and regional institutions and networks. This also poses a risk to the global consensus on climate change and sustainable development.

Water-constrained future

Global water demand is expected to outstrip supply by 2030. A growing middle class, climate change and a decline in water quality are leading to an increase in demand.

Several world regions are already experiencing severe water crises, including floods, polluted waterways and droughts. Government regulations increasingly focus on the availability of water, creating demand for solutions that reduce water consumption and improve wastewater quality.

"Some of these emerging risks also pose opportunities for a business such as Novozymes with our strong focus on sustainability and innovative solutions."