2017 results

Sales to the Household Care industry increased by 1% organically and were flat in DKK for 2017.

In Europe, the Middle East & Africa, sales were flat for the year. Throughout 2017, we have seen that some large global customers reformulated, while others increasingly focused on performance and boosted their enzyme inclusion. Sales in North America grew over last year after a good pick-up in the fourth quarter.

Sales in Asia Pacific were solid. Throughout the year, growth in Asia Pacific and especially China has enjoyed support from increased enzyme inclusion in the growing liquid segment. This positive development has been enabled by new innovation that has improved the stability of enzymes in liquid detergents.

In Latin America, sales ended down, mainly due to continued weak market conditions. Sales for automatic and hand dishwash continued to deliver good growth, driven by innovation and sustainability, partly from increased demand for phosphate-free solutions. The first shipments of enzymes from the freshness & hygiene platform occurred in the fourth quarter. Sales from the platform are expected to pick up over 2018 and impact sales growth in the second half of 2018.

2018 outlook

In Household Care, sales growth will be driven by increased penetration in emerging markets, where we intend to tap into consumer trends with our innovative enzymes for liquid detergents. The first sales from the freshness & hygiene platform are expected to increasingly contribute to growth from the second half of 2018. We expect the reformulation focus from some of our large customers to continue, especially at the beginning of the year, which puts a dampener on growth. While the developed markets Markets that have a highly developed economy and advanced technology infrastructure relative to less industrialized markets. North America, Central Western Europe, Australia, New Zealand, Japan and South Korea. Rest of the world is considered as emerging markets. continue to be dynamic, innovation, performance and differentiation remain in focus for both existing and new customers.

Key industry trends

- Growth in the liquid and unit dose market, driven by consumer convenience and stronger investments in these categories

- Rising demand for Household Care solutions tailored to emerging-market needs such as hot and humid conditions and demand for mild hand-washing alternatives

- Continued pressure on certain global customers leading to formulation changes

2017 results

Food & Beverages sales grew by 9% organically and by 8% in DKK for 2017.

Throughout 2017, Food & Beverages delivered solid, broad-based growth. Nutrition and starch were the most significant growth contributors. Sales in baking performed well despite headwinds in the US market for freshkeeping enzymes. Throughout 2017, we have implemented price reductions to position the US baking business ahead of a patent expiration in late Q1 2018. Baking enzyme sales in Europe, the Middle East and Africa performed well and more than offset the impact from the North American price reductions.

Sales of enzymes for nutrition were strong in 2017, supported by robust uptake of recent years’ innovation. This was coupled with increased demand for lactose reduction in dairy products and gains in enzyme market share within infant nutrition.

Sales for starch conversion were solid across geographies. This was driven by good traction from innovation as well as a positive impact from favorable corn prices relative to sugar in the Chinese starch market.

2018 Outlook

In Food & Beverages, organic sales growth is expected to be driven by continued step-up in commercial presence, especially in the emerging markets, as well as by new products. Baking is still expected to be impacted by price reductions in the North American freshkeeping market, while sales are expected to perform well in other markets. Enzymes for low-lactose dairy products are expected to continue their positive growth trend. In general, we expect continued good growth across industries.

Key industry trends

- Consumer focus on health, wellness and natural products

- Volatile raw material costs and focus on production process optimization

- Customers consolidating operations in order to increase overall efficiency

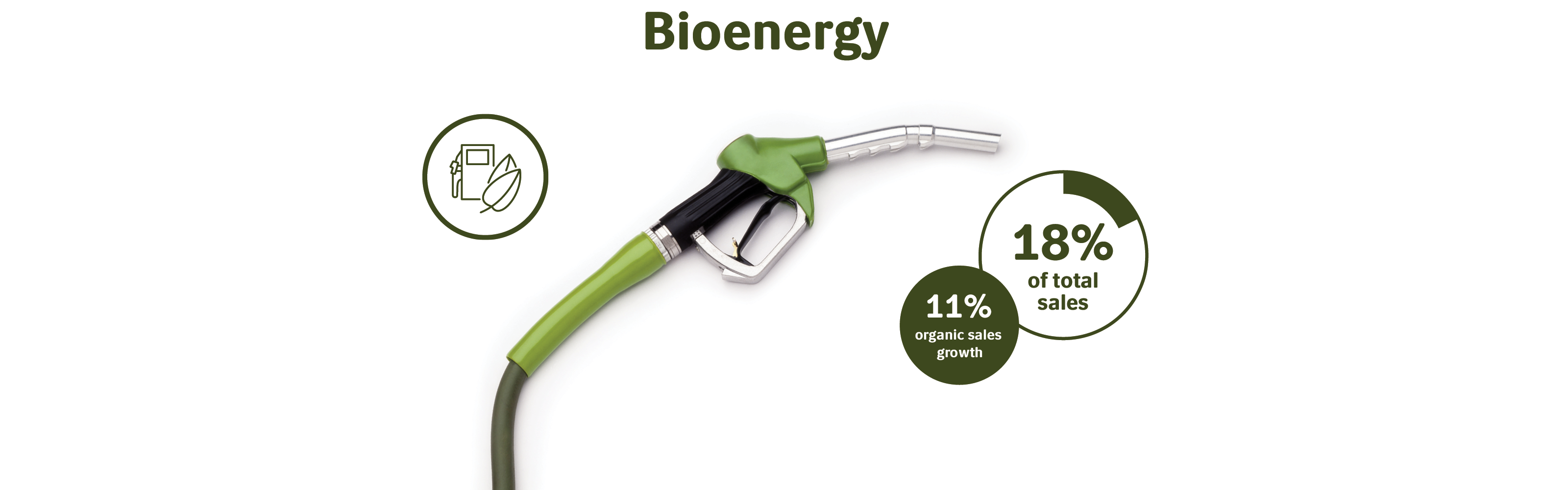

2017 results

Bioenergy sales grew by 11% organically and by 8% in DKK compared with 2016.

The good performance in 2017 was driven by Novozymes’ broader product portfolio and strong focus on tailoring process-specific solutions to individual customer needs. Sales of enzymes for conventional biofuels in North America were supported by increased production of ethanol, estimated to be 2-3% higher compared with 2016. While production grew in 2017, the US ethanol inventory level remains high, and producer margins are weak. Other geographies posted good growth but represent a smaller proportion of total Bioenergy sales.

Sales of enzymes for biomass conversion contributed marginally to Bioenergy sales growth in 2017.

2018 outlook

In Bioenergy, organic sales growth is expected to be driven mainly by new product launches and increased penetration from innovation.

We expect US ethanol production for 2018 to be roughly on par with 2017, but note that US ethanol inventory levels remain high. Good sales development is expected to continue, as technology introduced over the last 18 months is adopted in the marketplace.

Yeast is added to the product portfolio early 2018 and will contribute to growth. Sales of enzymes for biomass-based ethanol are expected to increase, but make up a small proportion of overall Bioenergy sales.

Key industry trends

- Growing calls for CO2 reduction in the transportation sector driving demand for ethanol

- Political push in favor of biofuels in several regions

- Volatility in commodity prices, affecting customer margins

2017 results

Agriculture & Feed sales declined by 3% organically and by 4% in DKK compared with 2016.

Sales of microbes to the agricultural industry declined, primarily due to slow pick-up in demand towards the end of the year. Farm economics continue to be under pressure and impact sales negatively. In The BioAg Alliance with Monsanto, focus is on the development and rollout of new products as well as on expanding into new regions to drive long-term growth. The pipeline is making very good progress.

Animal health and nutrition organic sales growth rates in 2017 were on par with the year before due to somewhat lower end-market demand for feed enzymes. Animal health sales continued to develop positively, albeit from a low base, as products are rolled out in the marketplace.

In 2017, Novozymes recognized DKK 202 million of deferred income as revenue, compared with DKK 194 million in 2016.

2018 outlook

In Agriculture & Feed, organic sales growth is expected to be driven primarily by good growth in BioAg, but animal health and nutrition is also expected to deliver growth. New product launches will benefit sales, especially in the second half of the year. The changed sales pattern and shift of sales from the first to the second half of the year that has been ongoing over the past years should now largely be completed. We will continue to monitor the potential acquisition of Monsanto by Bayer, but currently do not expect this to have implications for our BioAg business in 2018. Sales to the agriculture-related markets are subject to some uncertainty, due primarily to global farm economics.

Novozymes expects to recognize around DKK 170 million of the deferred income in BioAg as revenue in 2018. Deferred income does not impact the calculation of organic sales growth rates; it impacts realized sales growth in DKK and has no cash flow impact.

Key industry trends

- Consumer focus on health, wellness and natural products

- Sensitivity to fluctuations in commodity prices among farmers

- Consolidation of large agricultural companies

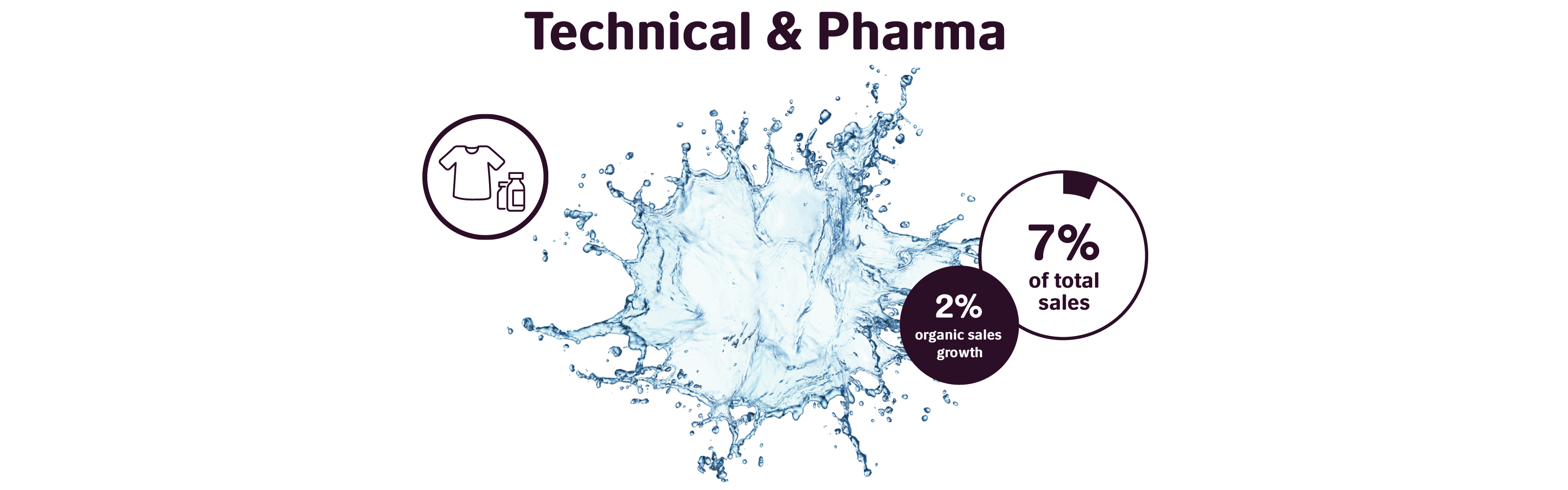

2017 results

Sales to the Technical & Pharma industries were up 2% organically and declined by 3% in DKK compared with 2016. Organic sales growth was mainly driven by Pharma.

In December 2017, Novozymes divested Albumedix, its stand-alone pharma entity which was separated from Novozymes in 2016. After a careful review, it has been concluded that the entity no longer benefits from being part of Novozymes. A good future ownership solution for Albumedix has therefore been found, with Novozymes retaining 8% ownership of the company.

Novozymes realized a net loss of DKK 66 million relating to this divestment.

2018 outlook

We expect Technical & Pharma to contribute to overall organic sales growth. Technical & Pharma is impacted by the divestment of Albumedix. The divestment will not impact organic growth. Looking ahead, the divestment will reduce some of the quarterly lumpiness in sales.

Key industry trends

- Continuous focus on process optimization and cost reduction

- Water scarcity driving demand for solutions that reduce water consumption, improve water quality and clean wastewater